Shape the future of consumer health.

-

Americas

-

Asia & Oceania

-

A-I

J-Z

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more -

Middle East & Africa

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more

Regions

-

Americas

-

Asia & Oceania

-

Europe

-

Middle East & Africa

-

Americas

-

Asia & Oceania

-

Europe

Europe

- Adriatic

- Belgium

- Bulgaria

- Czech Republic

- Deutschland

- España

- France

- Greece

- Hungary

- Ireland

- Israel

- Italia

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more -

Middle East & Africa

EMEA Thought Leadership

Developing IQVIA’s positions on key trends in the pharma and life sciences industries, with a focus on EMEA.

Learn more

SOLUTIONS

-

Research & Development

-

Real World Evidence

-

Commercialization

-

Safety & Regulatory Compliance

-

Technologies

LIFE SCIENCE SEGMENTS

HEALTHCARE SEGMENTS

- Information Partner Services

- Financial Institutions

- Global Public Health

- Government

- Patient Associations

- Payers

- Providers

THERAPEUTIC AREAS

- Cardiovascular

- Cell and Gene Therapy

- Central Nervous System

- GI & Hepatology

- Infectious Diseases and Vaccines

- Oncology

- Pediatrics

- Rare Diseases

- View All

Impacting People's Lives

"We strive to help improve outcomes and create a healthier, more sustainable world for people everywhere.

LEARN MORE

Harness the power to transform clinical development

Reimagine clinical development by intelligently connecting data, technology, and analytics to optimize your trials. The result? Faster decision making and reduced risk so you can deliver life-changing therapies faster.

Research & Development OverviewResearch & Development Quick Links

Real World Evidence. Real Confidence. Real Results.

Generate and disseminate evidence that answers crucial clinical, regulatory and commercial questions, enabling you to drive smarter decisions and meet your stakeholder needs with confidence.

REAL WORLD EVIDENCE OVERVIEWReal World Evidence Quick Links

See markets more clearly. Opportunities more often.

Elevate commercial models with precision and speed using AI-driven analytics and technology that illuminate hidden insights in data.

COMMERCIALIZATION OVERVIEWCommercialization Quick Links

Service driven. Tech-enabled. Integrated compliance.

Orchestrate your success across the complete compliance lifecycle with best-in-class services and solutions for safety, regulatory, quality and medical information.

COMPLIANCE OVERVIEWSafety & Regulatory Compliance Quick Links

Intelligence that transforms life sciences end-to-end.

When your destination is a healthier world, making intelligent connections between data, technology, and services is your roadmap.

TECHNOLOGIES OVERVIEWTechnology Quick Links

CLINICAL PRODUCTS

COMMERCIAL PRODUCTS

COMPLIANCE, SAFETY, REG PRODUCTS

BLOGS, WHITE PAPERS & CASE STUDIES

Explore our library of insights, thought leadership, and the latest topics & trends in healthcare.

DISCOVER INSIGHTSTHE IQVIA INSTITUTE

An in-depth exploration of the global healthcare ecosystem with timely research, insightful analysis, and scientific expertise.

SEE LATEST REPORTSFEATURED INNOVATIONS

-

IQVIA Connected Intelligence™

-

IQVIA Healthcare-grade AI™

-

Human Data Science Cloud

-

IQVIA Innovation Hub

-

Decentralized Trials

-

Patient Experience Solutions with Apple devices

WHO WE ARE

- Our Story

- Our Impact

- Commitment to Public Health

- Code of Conduct

- Environmental Social Governance

- Privacy

- Executive Team

NEWS & RESOURCES

Unlock your potential to drive healthcare forward

By making intelligent connections between your needs, our capabilities, and the healthcare ecosystem, we can help you be more agile, accelerate results, and improve patient outcomes.

LEARN MORE

IQVIA AI is Healthcare-grade AI

Building on a rich history of developing AI for healthcare, IQVIA AI connects the right data, technology, and expertise to address the unique needs of healthcare. It's what we call Healthcare-grade AI.

LEARN MORE

Your healthcare data deserves more than just a cloud.

The IQVIA Human Data Science Cloud is our unique capability designed to enable healthcare-grade analytics, tools, and data management solutions to deliver fit-for-purpose global data at scale.

LEARN MORE

Innovations make an impact when bold ideas meet powerful partnerships

The IQVIA Innovation Hub connects start-ups with the extensive IQVIA network of assets, resources, clients, and partners. Together, we can help lead the future of healthcare with the extensive IQVIA network of assets, resources, clients, and partners.

LEARN MORE

Proven, faster DCT solutions

IQVIA Decentralized Trials deliver purpose-built clinical services and technologies that engage the right patients wherever they are. Our hybrid and fully virtual solutions have been used more than any others.

LEARN MORE

IQVIA Patient Experience Solutions with Apple devices

Empowering patients to personalize their healthcare and connecting them to caregivers has the potential to change the care delivery paradigm.

LEARN MOREWORKING AT IQVIA

Our mission is to accelerate innovation for a healthier world. Together, we can solve customer challenges and improve patient lives.

LEARN MORELIFE AT IQVIA

Careers, culture and everything in between. Find out what’s going on right here, right now.

LEARN MORE

WE’RE HIRING

"Improving human health requires brave thinkers who are willing to explore new ideas and build on successes. Unleash your potential with us.

SEARCH JOBS- Blogs

- Poor cough and cold season restricts OTC growth in 2023

The global over the counter (OTC) healthcare products market in 2023 witnessed intriguing dynamics, marked by shifts in growth trajectories and regional performances, but the headline remains that a poor cough and cold season will always hit overall market growth.

Let’s explore the key takeaways from 2023:

1. Impact of Weak Cough and Cold Season on Overall Growth

The global OTC market underperformed forecasts as a notably weak cough and cold season restricted overall value sales growth to 3.9% for 2023. As the largest market segment, the performance of the cough and cold category strongly influences the overall growth trajectory of the OTC market. With subdued seasonal activity globally, the market faced downward pressure, highlighting the sector’s susceptibility to seasonal variations.

Figure 1: Global OTC market performance 2019-2023 (Source: IQVIA Global OTC Insights plus estimates of e-Commerce & Mass-market - Excluding Venezuela)

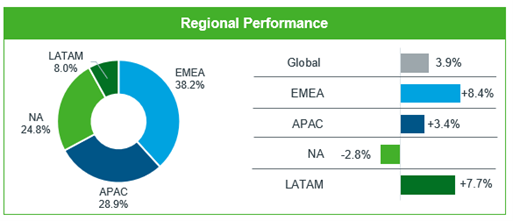

2. Regional Variances in Performance

EMEA (Europe, the Middle East, and Africa) emerged as the largest OTC region in 2023 boasting a value sales growth rate of approximately 8%. However, regional disparities were evident, with APAC now positioning itself as the second-largest region. Notably, North America experienced a decline in value by -2.8% for the full year, signaling challenges within the region, including price increases as well as a weak cough and cold season. Conversely, LATAM (Latin America) continued to exhibit resilience with a growth rate of around 7%.

Figure 2: OTC 2023 market performance broken down by regional share and value sales growth (Source: IQVIA Global OTC Insights plus estimates of e-Commerce & Mass-market - Excluding Venezuela)

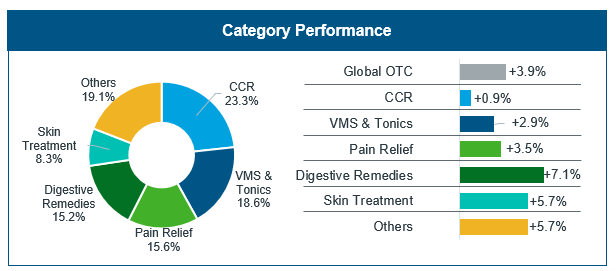

3. Category Dynamics and Market Resilience

Analyzing performance by category sheds light on the market’s resilience amidst fluctuating conditions. While cough and cold products remain the largest category, the overall market’s pace slows down when this segment underperforms. What is noteworthy however is the steady growth in digestive remedies and skin treatment categories, surpassing the market average (see Figure 3). This underscores the importance of diversification and innovation strategies when navigating evolving consumer preferences and market dynamics.

Figure 3: Global category performance by share and value sales growth in 2023 (Source: IQVIA Global OTC Insights plus estimates of e-Commerce & Mass-market - Excluding Venezuela)

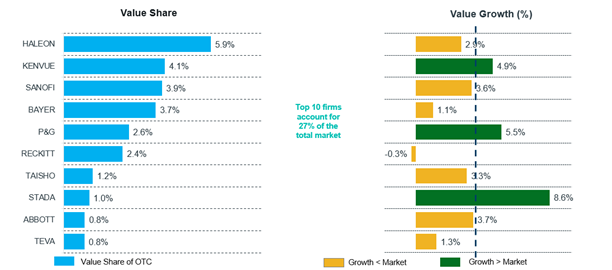

4. Stada’s strategy leads the way

In terms of company performance in 2023, Germany-based Stada was the clear stand out performer in the Top 10. Having posted strong first-half growth (see Holding Steady – Global OTC Market Update Q2 MAT.), the firm secured its place as the fastest growing major player, with OTC sales up by 8.6% for 2023 (see Figure 4).

Figure 4: Top 10 OTC companies globally by share and growth (Source: Source: IQVIA Global OTC Insights plus estimates of e-Commerce & Mass-market - Excluding Venezuela)

Commenting on its performance in its 2023 results release[i], Stada said it success had been built on both establishing market leadership in Germany - through growth from brands such as Grippostad, Silomat, Multilind, Elotrans and Hoggar - and expanding its position in Belgium, France, Italy, and Spain, as recently acquired brands performed strongly. The company expanded its regional reach in July 2023 through the acquisition of a basket of brands such as Antistax, Lomudal, Omnivit and Opticrom from Sanofi, building on an existing successful commercialization partnership in 20 European countries.

5. Projections for 2024: A Tale of Two Halves

We foresee a mixed outlook for 2024. In the first half we are anticipating growth rates ranging from 4% to 6%, reflecting continued challenges and uncertainties, including the closing months of the cough and cold season. However, we believe there are reasons for optimism in the back end of the year, with sales growth expected to rebound to 6% and 8%. This forecast underscores the resilience of the OTC healthcare products market, fueled by anticipated market stabilization and recovery.

For more insights on the state of today’s OTC market contact the team consumer.health@iqvia.com or click the CONTACT US button on this page.

[i] https://www.stada.com/blog/posts/2024/march/stada-continues-with-double-digit-sales-and-profit-growth-in-2023

Learn More

Dynamics of Self-Care Medical Devices in Europe

Consumer Health Capsule

Consumer Health Edge Podcasts

Related solutions

Illuminate a path to consumer health success

Adapt fast, maintain momentum and stay relevant